Get Pandas Datareader

ProTip: Be sure to remove /docs and /test if you forked Minimal Mistakes. These folders contain documentation and test pages for the theme and you probably don’t want them littering up your repo.

1

2

3

| import pandas as pd

import numpy as np

from pandas_datareader import data

|

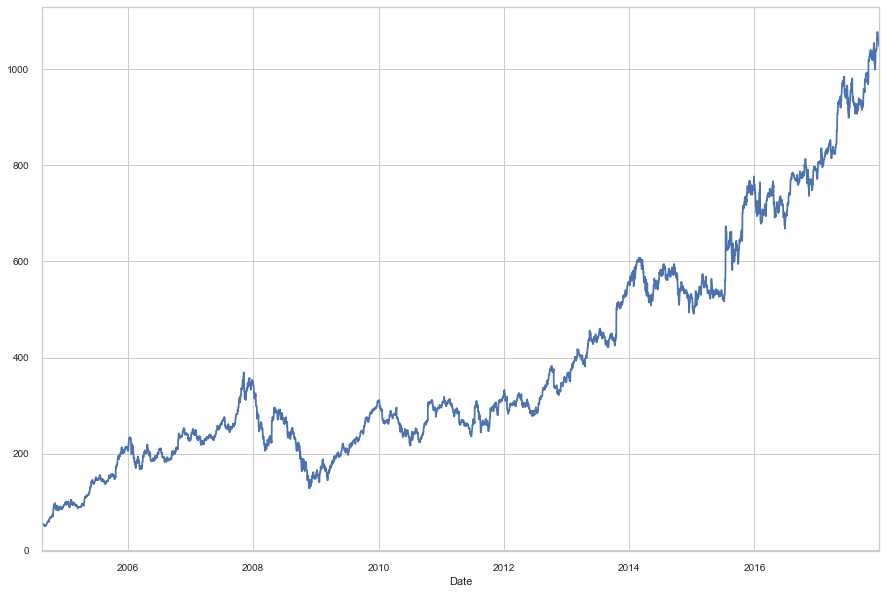

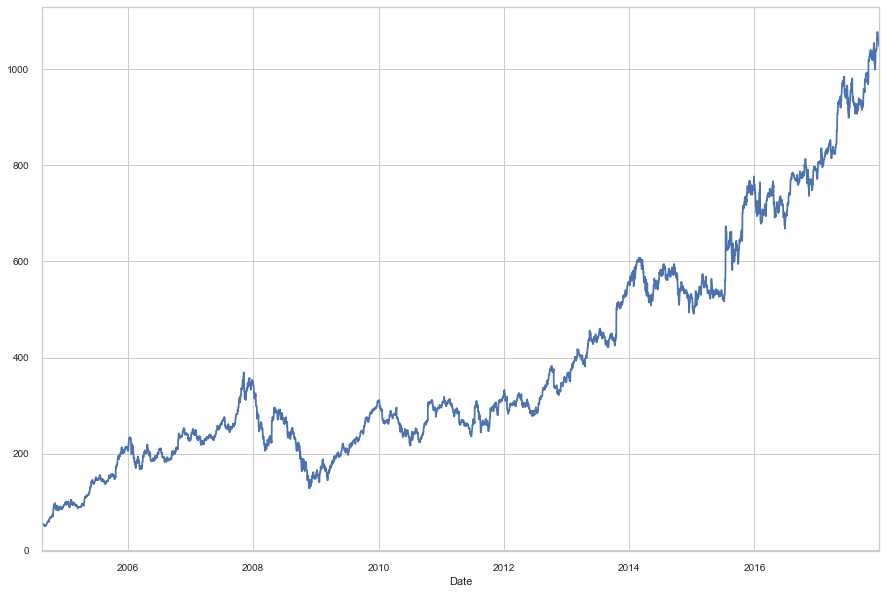

Get Google stock prices

1

2

| goog = data.DataReader('GOOG', start='2004', end='2018', data_source='yahoo')

goog.head()

|

|

High |

Low |

Open |

Close |

Volume |

Adj Close |

| Date |

|

|

|

|

|

|

| 2004-08-19 |

51.835709 |

47.800831 |

49.813286 |

49.982655 |

44871300.0 |

49.982655 |

| 2004-08-20 |

54.336334 |

50.062355 |

50.316402 |

53.952770 |

22942800.0 |

53.952770 |

| 2004-08-23 |

56.528118 |

54.321388 |

55.168217 |

54.495735 |

18342800.0 |

54.495735 |

| 2004-08-24 |

55.591629 |

51.591621 |

55.412300 |

52.239193 |

15319700.0 |

52.239193 |

| 2004-08-25 |

53.798351 |

51.746044 |

52.284027 |

52.802086 |

9232100.0 |

52.802086 |

1

| goog_p = goog['Adj Close']

|

1

2

3

4

| %matplotlib inline

import matplotlib.pyplot as plt

plt.style.use('seaborn-ticks')

import seaborn; seaborn.set_style('whitegrid')

|

1

| goog_p.plot(figsize=(15,10))

|

1

| <matplotlib.axes._subplots.AxesSubplot at 0x128dc0610>

|

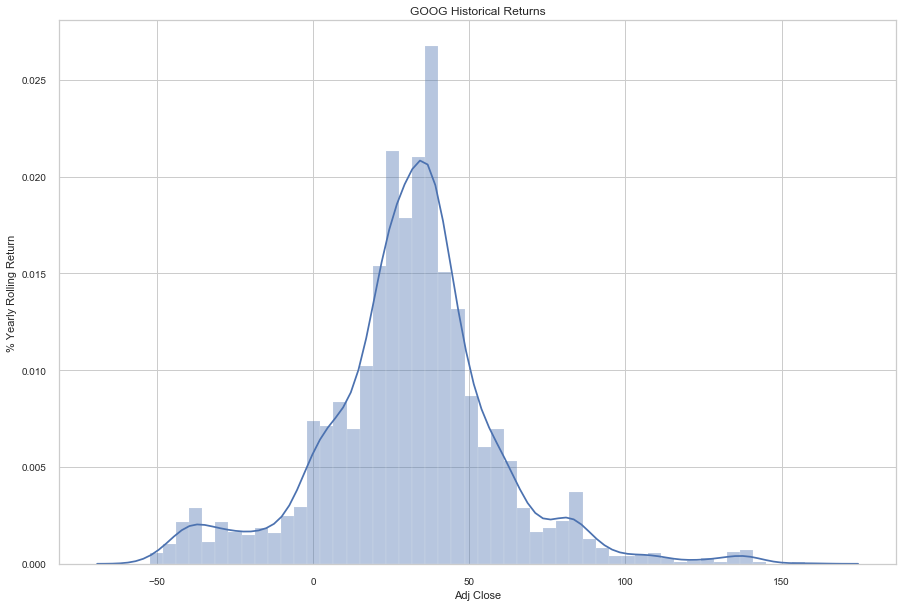

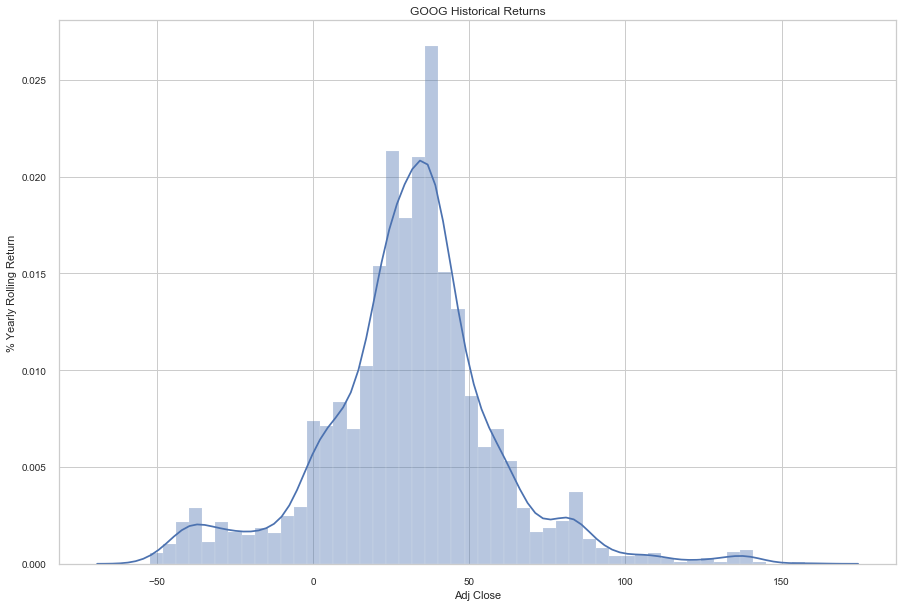

Compute Yearly Return

A common context for financial timeseries data is computing difference over time. For example, we can calculate one-year returns using pandas.

1

2

3

4

5

| goog_p = goog_p.asfreq('D', method='pad')

ROI = 100 * (goog_p.tshift(-365)/goog_p - 1)

ROI.plot(figsize=(15, 10))

plt.ylabel('% Return on Investment');

|

1

2

| y1_return = goog['Adj Close'].pct_change().rolling(365).sum().dropna()

y1_vol = goog['Adj Close'].pct_change().rolling(365).std().dropna()

|

1

2

3

4

| plt.figure(figsize=(15, 10))

seaborn.distplot(y1_return*100)

plt.ylabel('% Yearly Rolling Return')

plt.title('GOOG Historical Returns');

|