Introduction to timeseries plots in Python

Imports

1

2

3

4

5

6

7

8

%matplotlib inline

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import math

from datetime import date

from nsepy import get_history

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

# NIFTY 50 index

nifty_50 = get_history(symbol="NIFTY 50",

start=date(2001,1,1),

end=date(2020,5,3),

index=True)

# NIFTY Next 50 index

nifty_next50 = get_history(symbol="NIFTY NEXT 50",

start=date(2001,1,1),

end=date(2020,5,3),

index=True)

# India VIX index

india_vix = get_history(symbol="INDIAVIX",

start=date(2001,1,1),

end=date(2020,5,3),

index=True)

1

nifty_50.shape, nifty_next50.shape, india_vix.shape

1

((4806, 6), (4806, 6), (2796, 7))

1

MKT = nifty_next50.join(nifty_50['Close'], how='outer', rsuffix='_N50').dropna()

1

2

3

data = MKT.rename(columns={'Close':'NN50','Close_N50':'N50'})\

.assign(NN50_returns=lambda x: np.log(x['NN50']/x['NN50'].shift(1)))\

.assign(N50_returns=lambda x: np.log(x['N50']/x['N50'].shift(1)))

1

data = data[['NN50', 'N50', 'NN50_returns', 'N50_returns']].dropna()

1

data.index = pd.DatetimeIndex(data.index)

1

2

3

4

5

6

7

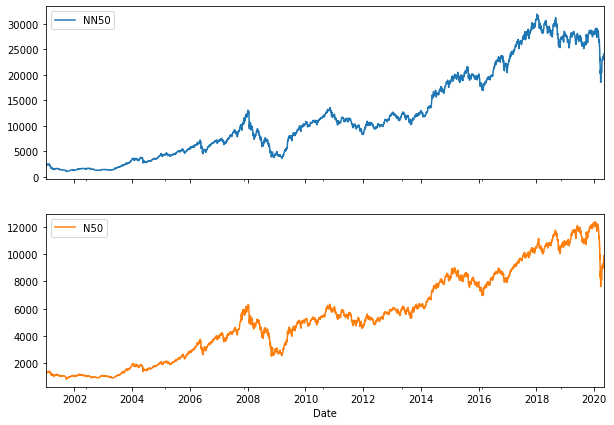

# Let's plot SPX and VIX cumulative returns with recession overlay

plot_cols = ['NN50', 'N50']

# 2 axes for 2 subplots

fig, axes = plt.subplots(2,1, figsize=(10,7), sharex=True)

data[plot_cols].plot(subplots=True, ax=axes)

1

2

3

array([<matplotlib.axes._subplots.AxesSubplot object at 0x11b5f6610>,

<matplotlib.axes._subplots.AxesSubplot object at 0x11a0cf8d0>],

dtype=object)

1

2

3

4

5

6

7

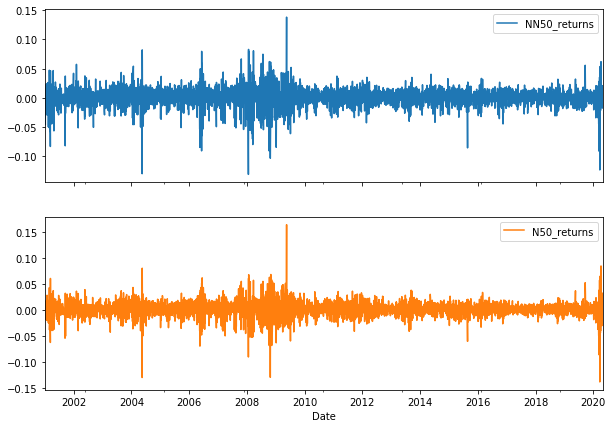

# Let's plot SPX and VIX cumulative returns with recession overlay

plot_cols = ['NN50_returns', 'N50_returns']

# 2 axes for 2 subplots

fig, axes = plt.subplots(2,1, figsize=(10,7), sharex=True)

data[plot_cols].plot(subplots=True, ax=axes)

1

2

3

array([<matplotlib.axes._subplots.AxesSubplot object at 0x11669c550>,

<matplotlib.axes._subplots.AxesSubplot object at 0x115ccc090>],

dtype=object)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

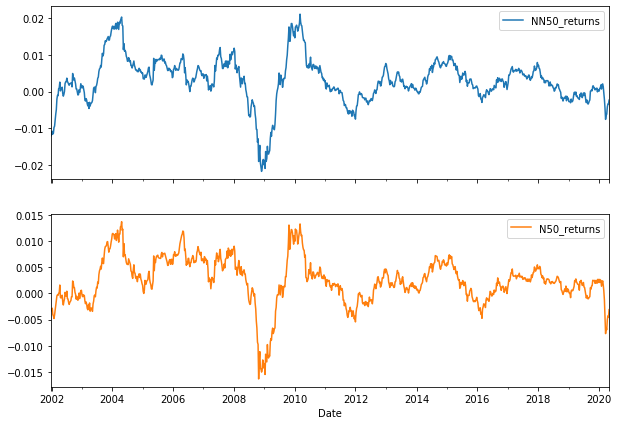

# ================================================================== #

# resample log returns weekly starting monday

lrets_resampled = data[['NN50_returns', 'N50_returns']].resample('W-MON').sum()

# ================================================================== #

# rolling mean returns

n = 52

roll_mean = lrets_resampled.rolling(window=n, min_periods=n ).mean().dropna(axis=0,how='all')

# ================================================================== #

# rolling sigmas

roll_sigs = lrets_resampled.rolling(window=n, min_periods=n ).std().dropna(axis=0,how='all') * math.sqrt(n)

# ================================================================== #

# rolling risk adjusted returns

roll_risk_rets = roll_mean/roll_sigs

1

2

3

4

5

6

7

# Let's plot SPX and VIX cumulative returns with recession overlay

plot_cols = ['NN50_returns', 'N50_returns']

# 2 axes for 2 subplots

fig, axes = plt.subplots(2,1, figsize=(10,7), sharex=True)

roll_mean[plot_cols].plot(subplots=True, ax=axes)

1

2

3

array([<matplotlib.axes._subplots.AxesSubplot object at 0x1165e9b50>,

<matplotlib.axes._subplots.AxesSubplot object at 0x11738d190>],

dtype=object)

1

2

3

4

data[['NN50', 'N50']].rolling(250).mean().head()

# \

# .assign(NN50_returns=lambda x: np.log(x['NN50']/x['NN50'].shift(1)))\

# .assign(N50_returns=lambda x: np.log(x['N50']/x['N50'].shift(1)))

| NN50 | N50 | |

|---|---|---|

| Date | ||

| 2001-01-02 | NaN | NaN |

| 2001-01-03 | NaN | NaN |

| 2001-01-04 | NaN | NaN |

| 2001-01-05 | NaN | NaN |

| 2001-01-08 | NaN | NaN |

1

2

%load_ext watermark

%watermark

1

2

3

4

5

6

7

8

9

10

11

12

13

14

The watermark extension is already loaded. To reload it, use:

%reload_ext watermark

2020-05-04T08:30:27+05:30

CPython 3.7.4

IPython 7.9.0

compiler : Clang 4.0.1 (tags/RELEASE_401/final)

system : Darwin

release : 19.4.0

machine : x86_64

processor : i386

CPU cores : 4

interpreter: 64bit

1