NIFTY Index Performance

NIFTY Index Performance

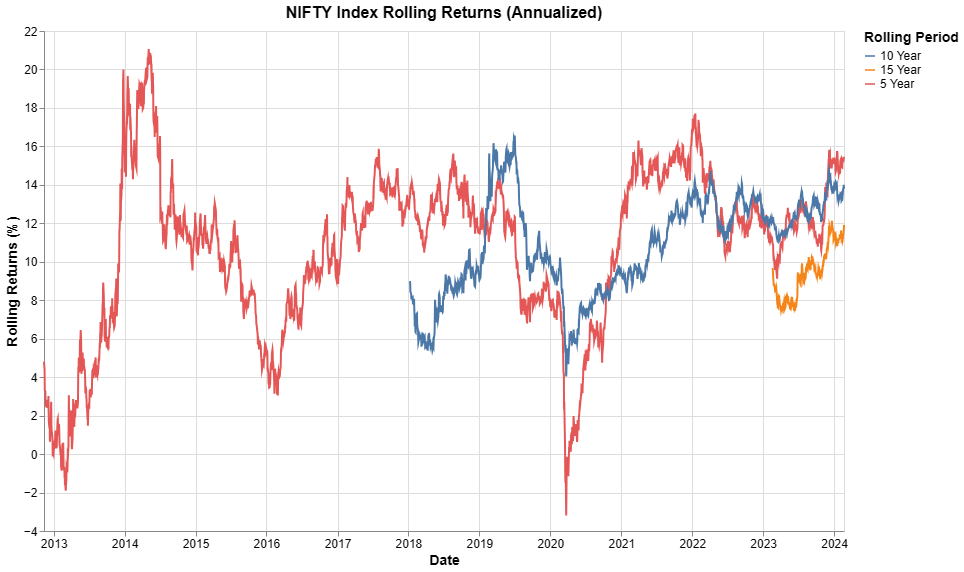

Here are some of the key insights from the chart and summary statistics:

| Period | Mean | Median | Min | Max | Std Dev |

|---|---|---|---|---|---|

| 10 Year | 10.88 | 11.30 | 4.04 | 16.56 | 2.56 |

| 15 Year | 9.47 | 9.44 | 7.47 | 12.13 | 1.34 |

| 5 Year | 10.74 | 11.72 | -3.20 | 21.06 | 4.19 |

Conclusion

The NIFTY Index has shown significant growth over the years, with clear upward trend in the last 10 years as we are in a bull market.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

import pandas as pd

import yfinance as yf

import altair as alt

import numpy as np

# Download NIFTY data (using ^NSEI ticker)

nifty = yf.download('^NSEI', start='1999-01-01', end='2024-02-22')

# Ensure we have the Adj Close column and calculate daily returns

if 'Adj Close' not in nifty.columns:

nifty['Adj Close'] = nifty['Close']

nifty['Daily_Return'] = nifty['Adj Close'].pct_change()

# Function to calculate rolling returns (annualized)

def calculate_rolling_returns(data, years):

rolling_periods = years * 252 # Using 252 trading days per year

rolling_returns = (1 + data['Daily_Return']).rolling(window=rolling_periods).apply(

lambda x: np.prod(x)) ** (252/rolling_periods) - 1

return rolling_returns * 100 # Convert to percentage

# Create an empty DataFrame for rolling returns

rolling_returns_df = pd.DataFrame()

rolling_returns_df.index = nifty.index

# Calculate different rolling returns

periods = [5, 10, 15, 20]

for period in periods:

col_name = f'{period}Y_Rolling'

rolling_returns_df[col_name] = calculate_rolling_returns(nifty, period)

# Reset index to make date a column

rolling_returns_df = rolling_returns_df.reset_index(drop=False)

# Melt the dataframe for Altair plotting

rolling_returns = pd.melt(

rolling_returns_df,

id_vars=['Date'],

value_vars=[f'{period}Y_Rolling' for period in periods],

var_name='Period',

value_name='Return'

)

# Clean up period names for display

period_mapping = {f'{period}Y_Rolling': f'{period} Year' for period in periods}

rolling_returns['Period'] = rolling_returns['Period'].map(period_mapping)

# Remove any NaN values

rolling_returns = rolling_returns.dropna()

# Create Altair chart

chart = alt.Chart(rolling_returns).mark_line().encode(

x=alt.X('Date:T', title='Date'),

y=alt.Y('Return:Q',

title='Rolling Returns (%)',

scale=alt.Scale(zero=False)),

color=alt.Color('Period:N', title='Rolling Period'),

tooltip=[

alt.Tooltip('Date:T', title='Date'),

alt.Tooltip('Return:Q', title='Return (%)', format='.2f'),

alt.Tooltip('Period:N', title='Period')

]

).properties(

width=800,

height=500,

title='NIFTY Index Rolling Returns (Annualized)'

).configure_axis(

labelFontSize=12,

titleFontSize=14

).configure_title(

fontSize=16

).configure_legend(

labelFontSize=12,

titleFontSize=14

)

# Display the chart

chart

# Calculate summary statistics

summary_stats = rolling_returns.groupby('Period')['Return'].agg([

('Mean', 'mean'),

('Median', 'median'),

('Min', 'min'),

('Max', 'max'),

('Std Dev', 'std')

]).round(2)

print("\nSummary Statistics of Rolling Returns:")

print(summary_stats)